Nemesis Wealth Projects provides easy access to DeFi

Decentralized finance, or DeFi, is a system for making financial products available on a decentralized blockchain network that is open to the public. DeFi refers to a system in which buyers, sellers, lenders, and borrowers interact peer to peer or with a strictly software-based middleman rather than a company or institution facilitating a transaction using software written on blockchains. As a result, instead of going through middlemen like banks or brokerages, anyone can use them. Unlike a bank or brokerage account, DeFi does not require a government-issued ID, Social Security number, or proof of address.

A variety of technologies work together to achieve the goal of decentralization. A decentralized system, for example, could be made up of open-source technologies, blockchain, and proprietary software. Smart contracts make these financial products possible, automating agreement terms between buyers and sellers or lenders and borrowers. DeFi systems are designed to eliminate intermediaries between transacting parties, regardless of the technology or platform used.

Although the volume of trading tokens and money locked in smart contracts in its ecosystem has been steadily increasing, DeFi is still a young industry with a nascent infrastructure. DeFi is also subject to little or no regulation or oversight.

The use of technology in financial services is not new. Nowadays, technology is used to complete majority of transactions at banks and other financial institutions However, in traditional transactions, the tole of technology is limited to that of a facilitator. Companies must still navigate the legalese of various jurisdictions, competing for financial markets and differing standards to complete a transaction. DeFi, with its stack of common software protocols and public blockchains on which to build them, puts technology at the forefront of financial transactions.

The components of DeFi assets are similar to those of existing financial ecosystems in that they require stable currencies and a diverse range of use cases. Stablecoins and services such as crypto exchanges and lending services are all examples of DeFi components. Smart contracts provide the framework for DeFi apps to function because they encode the terms and conditions required for these services to function. A smart contract code, for example, has a specific code that establishes the exact terms and conditions of an individual loan. Collateral may be liquidated if certain terms or conditions are not met. All of this is done through a code rather than manually through a bank or other institution.

A software stack contains all of the components of a decentralized financial system. The components of each layer are designed to perform a specific function in the construction of a DeFi system. Composability is a distinguishing feature of the stack because the components from each layer can be combined to create a DeFi app.

Let’s dive into the four layers that comprise the DeFi stack; settlement layer, protocol layer, application layer, and aggregation layer.

The settlement layer is also known as Layer 0 because it serves as the foundation for all other DeFi transactions. It is made up of a public blockchain and a digital currency or cryptocurrency. This currency, which may or may not is traded on public markets, is used to settle transactions on DeFi apps. Ethereum and its native token ether (ETH), traded on crypto exchanges, are an example of the settlement layer. Tokenized versions of assets, such as the US dollar, or tokens that are digital representations of real-world assets, can be used in the settlement layer. A real estate token, for example, could represent the ownership of a piece of land.

Secondly, software protocols are written rules and standards that govern specific tasks or activities. This would be a set of principles and rules that all participants in a given industry have agreed to follow as a condition of operating in the industry, similar to real-world institutions. DeFi protocols are interoperable, which means multiple entities can use them to create a service or app simultaneously. The protocol layer gives the DeFi ecosystem liquidity. Synthetix, an Ethereum-based derivatives trading protocol, is an example of a DeFi protocol. It’s used to make digital replicas of real-world assets.

The application layer is where consumer-facing applications live, as the name implies. This layer houses the majority of the cryptocurrency ecosystem’s applications, such as decentralized cryptocurrency exchanges and lending services. The underlying protocols are abstracted into simple consumer-focused services in these applications.

Lastly, aggregators connect various applications from the previous layer to provide a service to investors in the aggregation layer. They might, for example, make it possible to transfer money seamlessly between different financial instruments to maximize returns. Such trading actions would require a lot of paperwork and coordination in a physical setup. On the other hand, a technology-based framework should smooth the investment rails, allowing traders to switch between different services quickly. Lending and borrowing are two examples of services offered on the aggregation layer. Other examples include banking services and cryptocurrency wallets.

Crypto wallets can take a few different forms, including desktop, mobile, online, hardware, and paper.

A desktop wallet is a wallet that is installed on a user’s computer and allows them to manage the funds sent to it. Desktop wallets are available in two varieties: thick and thin. Users of thick desktop wallets can download the entire blockchain and manage their funds with an independent security team. On the other hand, users of thin wallets do not need to download blocks and the wallet easily be transferred to a mobile device.

The main advantage of a mobile wallet is that the user’s funds are always available. Scanning QR codes to pay for items can be convenient. In some cases, users can use the near-field communication (NFC) feature on their smartphone, which allows them to tap their phone against a reader without entering any information. All mobile wallets have one thing in common: they do not require users to run a full Bitcoin node. Running a full Bitcoin node is complex because one must download the entire blockchain, which is constantly growing and takes up lots of space.

A users’ private keys are stored on an online server that is controlled by someone else and connected to the internet when using a web-based wallet. While it allows users to access their funds from virtually any device, anywhere in the world, there is always the possibility that the server will be hacked or that the service operator will seize control of a user’s Bitcoin. There’s a lot to consider when it comes to purchasing and managing Bitcoin.

Hardware wallets are portable devices that store private keys on their own. They come in many different shapes and sizes, but they all allow users to carry virtually any amount of cryptocurrency in their pockets.

Finally, a paper wallet contains two pieces of information that are presented in the form of characters and QR codes generated by a specific service. The first crucial piece of information is a wallet address, which can be used to receive BTC. The other is a private key, which enables users to spend Bitcoin stored at a specific address.

The evolution of decentralized finance is still in its early stages. As of March 2021, the total value of DeFi contracts was more than $41 billion. The total value locked is calculated by multiplying the number of tokens in the protocol by their USD value. Though the total figure for DeFi may appear large, it is essential to remember that it is only a theoretical figure. This is because many DeFi tokens lack sufficient liquidity and volume to trade on cryptocurrency exchanges.

Infrastructural mishaps and hacks continue to plague the DeFi ecosystem. In the rapidly evolving DeFi infrastructure, scams abound as well. Hacker “rug pulls,” in which funds are drained from a protocol and investors are unable to trade, are common, though there are well-established protocols that can significantly reduce this risk.

As we know, the open and dispersed nature of the decentralized finance ecosystem may also cause issues with current financial regulation. Current laws are based on the concept of distinct financial jurisdictions, each with its own set of laws and regulations. The borderless transaction span of DeFi also raises serious regulatory issues.

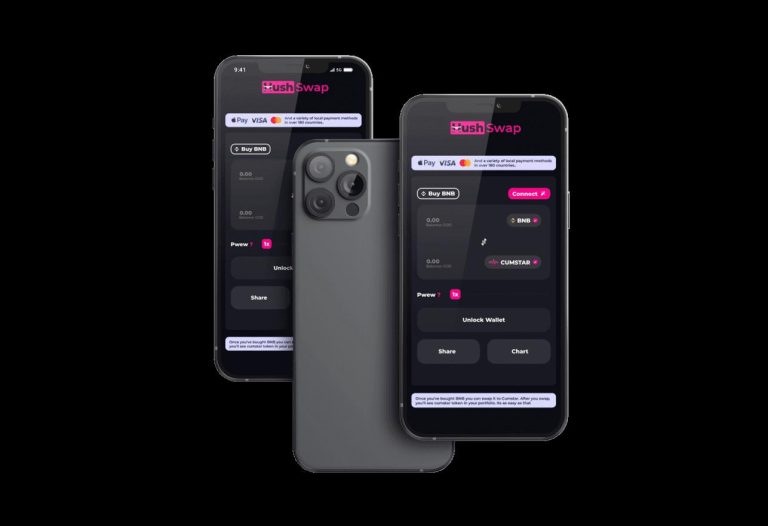

The team at Nemesis Wealth Projects is on a mission to create software and applications that make DeFi more accessible. With the upcoming user-friendly APP Wallet+Buy, users can purchase and safely store assets on their mobile phones quickly. Thanks to an update on the Swap+Shop function, users can also shop anywhere in the world using their tokens. In short, the company intends to provide a diverse range of assets that crypto investors can use in their daily lives. Upon their release, all the tokens were protected in four sections of the Nemesis Ecosystem: financial services, art and charity, meme and gaming, and business services.

For more information about Nemesis Wealth Projects, click here.

I am a Crypto author and journalist. I have been writing about cryptocurrencies and blockchains for over 5 years. I have also been a guest on numerous podcasts and radio shows, discussing these topics. In addition, I am also a crypto advisor and consultant.